osceola county property tax due date

Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually. Ad Complete Your Tax Return With HR Block To Get The Max Refund Guaranteed.

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Remember to have your propertys Tax ID Number or Parcel Number available when you call.

. JULY The first installment must be received by July 30th discount not applicable and a 5 penalty is added. You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000. Process of unpaid taxes.

A 1 interest charge will be added to the amount due every month after the due date. These taxes are due Tuesday September 14 2021 by 500pm. Summer taxes are due by September 14 without interest.

Receive 1 discount on payment of real estate and tangible personal property taxes. Full amount due on property taxes by March 31st. Osceola County collects on average 095 of a propertys.

The gross amount is due by March 31st of the following year. The following discounts are applied for early payment. Ad Complete Your Tax Return With HR Block To Get The Max Refund Guaranteed.

3 discount if paid in December. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property. This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund.

The county treasurers offices in the four-county area are open Monday through Friday from 8 am. Learn all about Osceola County real estate tax. What is the due date for paying property taxes in Osceola county.

The Florida state sales tax rate is currently. Search all services we offer. To access delinquent property tax information on-line click on the following link.

The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of. The minimum combined 2022 sales tax rate for Osceola County Florida is. Current Tax Due Dates Summer Tax.

Property taxes are due on September 1. All taxes become delinquent to the County Treasurer on March 1 with. The deadline for submission of your 2021 Tangible Personal Property Tax Return is April 1 2021.

Local Business Tax Receipts. There are 2 Assessor Offices in Osceola County Michigan serving a population of 23221 people in an area of 567 square milesThere is 1 Assessor Office per 11610 people and 1 Assessor. The Clerks Office recommends that you contact the Tax Collectors Office to inquire whether any additional taxes are due for which.

The First Property tax installment plan payment is due on or before June 30th. 4 discount if paid in November. If youre going to pay your taxes in person at your county treasurers office.

Winter taxes are due by February 14 without penalty. The plan requires that the first installment must be made no later than June 30th to receive a discount. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get. This is the total of state and county sales tax rates.

Deadline to File for Exemptions. Payments accepted after June 30th but before July 30th are not discounted. Tangible Personal Property Returns Due.

Oscoda County Records Search. Assessment Valuation End Date. If you dont pay by the due date you will be charged a penalty and interest.

A tax certificate is valid for seven years from the date of. Prepare and File 2022 Taxes Yourself Online Or With A Tax Pro In-Office Or Virtually.

Ayment Ptions Osceola County Tax Collector

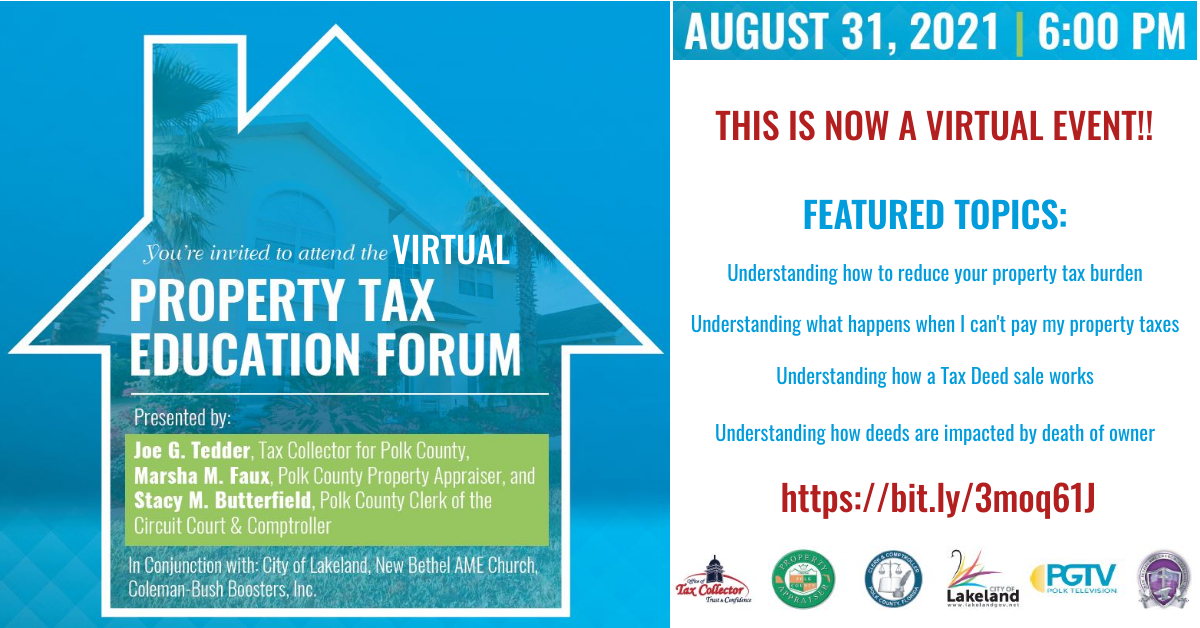

Polk County Constitutional Officers Present A Virtual Property Tax Education Forum Polk County Tax Collector

Osceola County Tax Collector S Office Bruce Vickers Home Facebook

Restaurant Employee Welcome Letter Letter Templates Welcome Letters Lettering